ONLINE ANTARIK BADLI

Subject: – To consider the above seniority of the teacher who has been transferred in the district internal transfer, to state on the above subject, to consider the original seniority of the teachers who have been transferred in the district internally this year, according to the representations received by this office. Was introduced.

Pursuant to which orders have been issued from the reference letter of the education department. “Assassination is part of the administrative process,” he said. In which case the teacher is compelled to change, if the seniority of his previous school goes to zero, he cannot participate in the internal transfer camp.

The seniority of the previous school should be taken into account in the internal transfer camp when the increase is administratively transferred. The matter has received the support of the Government.

According to which the teachers who can apply in the district internal transfer camp keeping in view the seniority of the existing school will be able to apply online as per the aforesaid order of the education department and the teachers who have applied showing the current school date of their transfer will be able to amend their previous school seniority date.

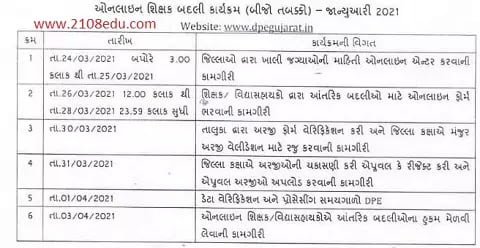

Necessary instructions will have to be given from your level in this regard. The timetable for verification / validation of applications from taluka, district and directorate level is as follows. According to which planning has to be carried out.

Note: Plz always check and confirm the above details with the official website and Advertisement/ notification

ONLINE ANTARIK BADLI

The total income of an assessee is determined after deductions from the gross total income are made as discussed in the previous chapter. It is on this total income that the tax payable is computed at the rates in force. The Income Tax Act further provides for the rebate from the tax payable as computed above, if certain investments or payments are made. Rebate provided u/s 88 of the Act must be distinguished from deductions provided in Chapter VIA of the Act. While the latter reduces the gross total income, rebate is a reduction from the tax payable.

On retirement, an employee normally receives certain retirement benefits. Such benefits are taxable under the head ‘Salaries’ as “profits in lieu of Salaries” as provided in Section 17(3). However, in respect of some of them, exemption from taxation is granted u/s 10 of the Income Tax Act, either wholly or partly.

Where the gratuity was received in any one or more earlier previous years also and any exemption was allowed for the same, then the exemption to be allowed during the year gets reduced to the extent of an exemption already allowed, the overall limit being Rs. 3.5 Lakhs.

ONLINE ANTARIK BADLI

SECOND PHASE:-

Antarik Badli camp Second Phase Download letter 22/03/2021 here

03/04/2021 ORDER DOWNLOAD LINK CLICK HERE

નમુનારૂપ:-